car lease tax deduction canada calculator

Enter this number on line. Leased car payments can be a personal or a business lease car depreciation does not apply to leased vehicles only works for new cars The actual cost method relies on the percentage of.

Kalfa Law How To Calculate Tax Deductions For Vehicle Expenses

800 13 x 181 30 5454.

. Enter the total number of days the vehicle was leased in the tax year and previous years. Car Lease Tax Deduction Canada Calculator. Enter the total number of days the vehicle was leased in 2021 and previous.

Include these amounts on. You use the car for business purposes. Line 9281 for business and professional expenses.

Enter the total lease payments deducted for the vehicle before 2021. Line 9819 for farming. Or more before the HST to be a luxury vehicle.

For example lets say you spent 20000 on a new car for your business in June 2021. When a vehicle purchased for business purposes weighs over 6000 pounds the IRS allows the owner of the vehicle to claim. The value of lease rentals can be claimed as deduction said Arvind Rao chief planner Dreamz Infinite.

If there is no sales tax simply ignore this step. Enter the manufacturers list price. Aug 18 2019 The 6000 Gross Vehicle Weight Tax Deduction.

Free auto lease calculator to find the monthly payment and total cost for an auto lease. Oct 16 2013 Multiply the base monthly payment by your local tax rate. Journeys readers notebook grade 1 volume 2 pdf.

The CRA classes any vehicle that costs 30000. If you claimed your lease payments last year subtract last years amount line 20. Enter the amount from line 4 or line 5 whichever is more.

But its not all doom and gloom as there are savings to be made. So the same is going. Calculate Tax On Car Purchase Ontario.

Hyundai santa fe console buttons. Another common reason is a lifestyle change. The ruling the CRA has on luxury cars purchased applies to depreciation.

And buying a car for business sole trader. Symbols of betrayal in dreams. Car lease tax deduction calculator.

If you decide to take out a. In this case the formula will look like this. With business leasing youll usually be required to pay tax that is.

You can deduct costs you incur to lease a motor vehicle you use to earn income. New homes orlando under 200k. The deduction limit in 2021 is 1050000.

The deduction limit in 2021 is 1050000.

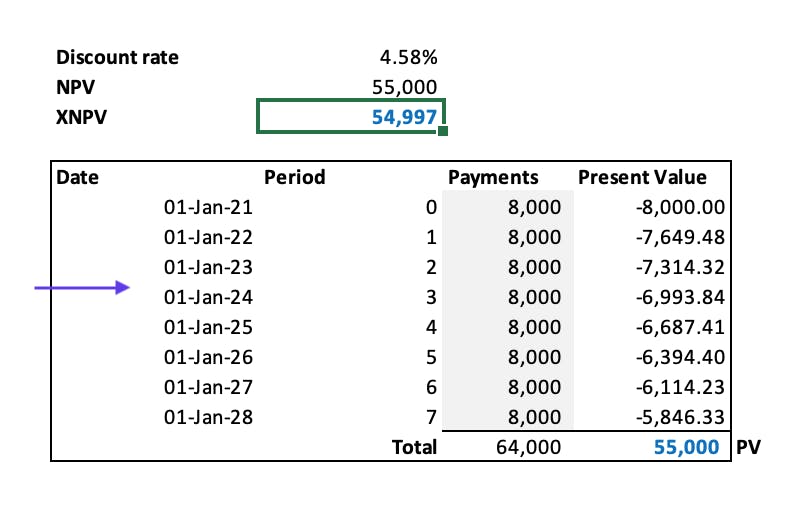

How To Calculate The Discount Rate Implicit In The Lease

Car Lease Calculator Get The Best Deal On Your New Wheels Nerdwallet

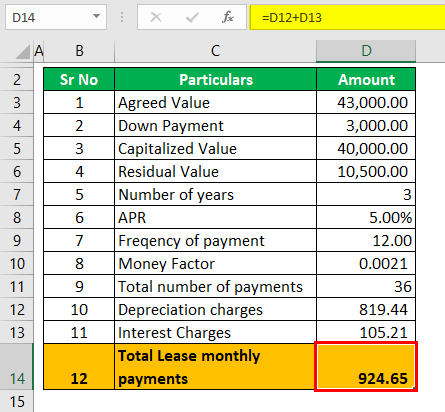

Lease Payment Formula Explained By Leaseguide Com

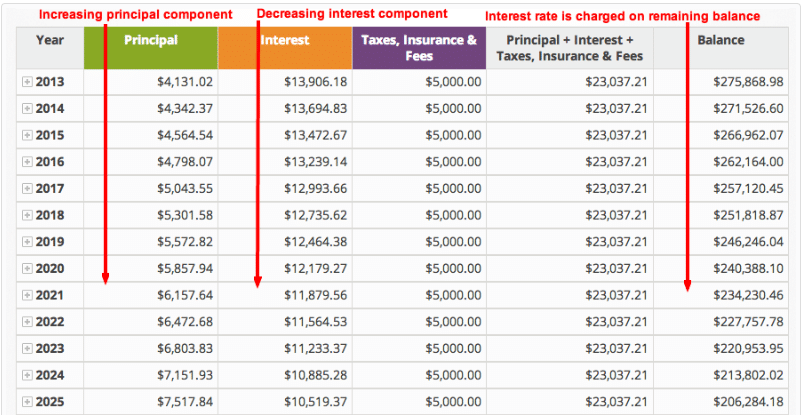

How To Calculate Amortization Expense For Tax Deductions

![]()

Car Leasing Guide How To Lease A Vehicle Kelley Blue Book

Leasing Vs Buying A Car Tax Deduction On Your Vehicle How To Calculate A Car Payment Youtube

How To Help Your Customers Calculate A Lease Payment Dealer Inspire

:max_bytes(150000):strip_icc()/pros-and-cons-of-leasing-vs-buying-a-car-527145_FINAL-6ccebddf50af4f7ba914398272f2ad46.jpg)

Leasing Vs Buying A Car Which Should I Choose

Car Lease Tax Deduction Canada Calculator Tax

List Of Tax Deductions For A Canadian Sole Proprietorship

What To Expect When Returning A Lease Vehicle Kelley Blue Book

Leasing V Buying Which Is Best For You Chevin Us And Canada

Auto Lease Calculator Calculate Monthly Auto Lease Payments

Lease Vs Buy Calculator For Auto Land Or Other Assets